Double-entry accounting ensures that every transaction is recorded properly. If money moves, at least two accounts change, such as one goes up, and another goes down. This system catches mistakes and helps stop fraud.

In this article, we will cover the following topics:

- What double-entry accounting is.

- Its core principles.

- How it works.

- Double-entry accounting advantages.

- Key components

- Types of business accounts in double-entry.

Let’s move on to the below section to understand what a double-entry system is in accounting.

Understanding Double-Entry Accounting

Double-Entry Accounting is an accounting for money. It’s the rule that every money entry has an opposite entry in another account. Debits and credits are words we use to refer to each half.

It’s more than 500 years old. It was originally described by an Italian mathematician named Luca Pacioli in his Summa de Arithmetica. These ideas spurred on business systems today and provided Luca with a new appellation: the father of accounting.

Before this time, most companies were using Single-Entry Accounting. In Single-Entry Accounting, every entry is only written once in a cash book. When a company receives cash, it posts income, and when it pays in cash, it posts a cost.

The result is a profit or a loss. This can be shown on a money report called the Income Statement.

I bring this up to show a challenge. Big companies like to buy and sell things on credit. They also have things like tools, and they owe things like loans. It is hard to keep track of all this with one cash book.

What such companies need is a Balance Sheet—a standalone money report that shows their things and what they owe at a given time.

Luca fixed this with a simple rule. He said that stuff equals debts plus ownership. A company owns stuff, and it owes debts to others and ownership to its owners. This is the accounting Rule, and it must always balance.

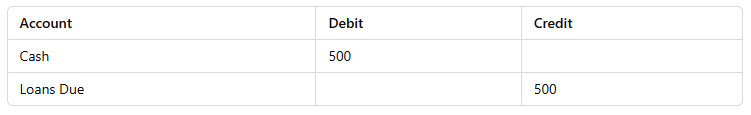

For example, if a business takes a loan of $500 from a bank, what happens? The business gets cash, which it owns, so its things increase. It also accounts for a loan it owes the bank. It owes this to someone else, so its obligations increase as well.

The accounting rule is still balanced to perfection. So how do credits and debits work here?

How Do Credits and Debits Work in Double-Entry Accounting?

Let’s move on to the following section to understand that.

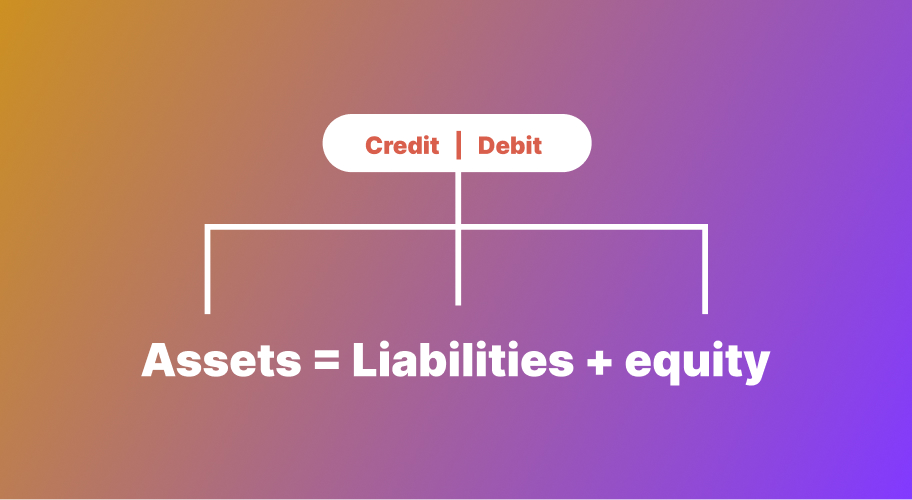

In Double-Entry Accounting, we don’t just consider cash inflow and cash outflow. We consider Debits and Credits. These represent the two faces of transactions. Debits always come on the left side of an account, and Credits come on the right side.

Assets = Liabilities + Equity

Hence, when a company borrows a loan of $500 from a bank, we debit its cash book to indicate the increase in stuff, and at the same time, we credit loans due to show a debt on the other side.

Anyway, let’s move on to the section below to take a look at the core principles of double-entry in accounting.

Core Principles of Double-Entry Accounting

Here are 5 principles for double-entry accounting:

- Dual-entry recording: Every transaction involves the altering of at least two accounts—one is “credit” and one else is “debit”. This keeps the accounting equation balanced.

- Debit and credit rules: Debits will increase assets and expenses but decrease liabilities and revenues. While credits will increase liabilities and revenue, they will decrease assets and expenses.

- The accounting equation always stays balanced: Every journal entry will keep the asset-liability-equity balance. Where they don’t, there’s an error.

- Accuracy and error detection: Due to the fact that every transaction has two postings, errors are easier to spot and rectify. A mismatch in balance reveals an issue.

- Transparency and financial integrity: Firms use this method to provide good financial records, which makes managing cash flow, tax returns, and obtaining easier. Investors, banks, and tax officials trust this method for reliable reporting.

Here are the advantages of double-entry accounting:

- All transactions are recorded in two accounts to reduce errors and give reliable financial data.

- Mistakes are easier to identify and fix since the accounting equation must always remain balanced.

- With a clear record of all transactions, it’s harder to manipulate financial data or hide fraudulent activities.

- Businesses can track income, expenses, assets, and liabilities more effectively, helping with budgeting and decision-making.

- Well-maintained financial records simplify tax preparation and ensure compliance with regulations.

- Banks, investors, and tax authorities rely on double-entry accounting for accurate financial reports, making it easier to secure loans and attract investors.

Let’s move on to the below part to see the double-entry key components.

Key Components of Double-Entry Accounting

- Transactions: Any financial activities affect a company’s accounts, such as sales, expenses, or investments.

- Accounts: Categories are used to record transactions such as assets, liabilities, equity, revenue, and expenses.

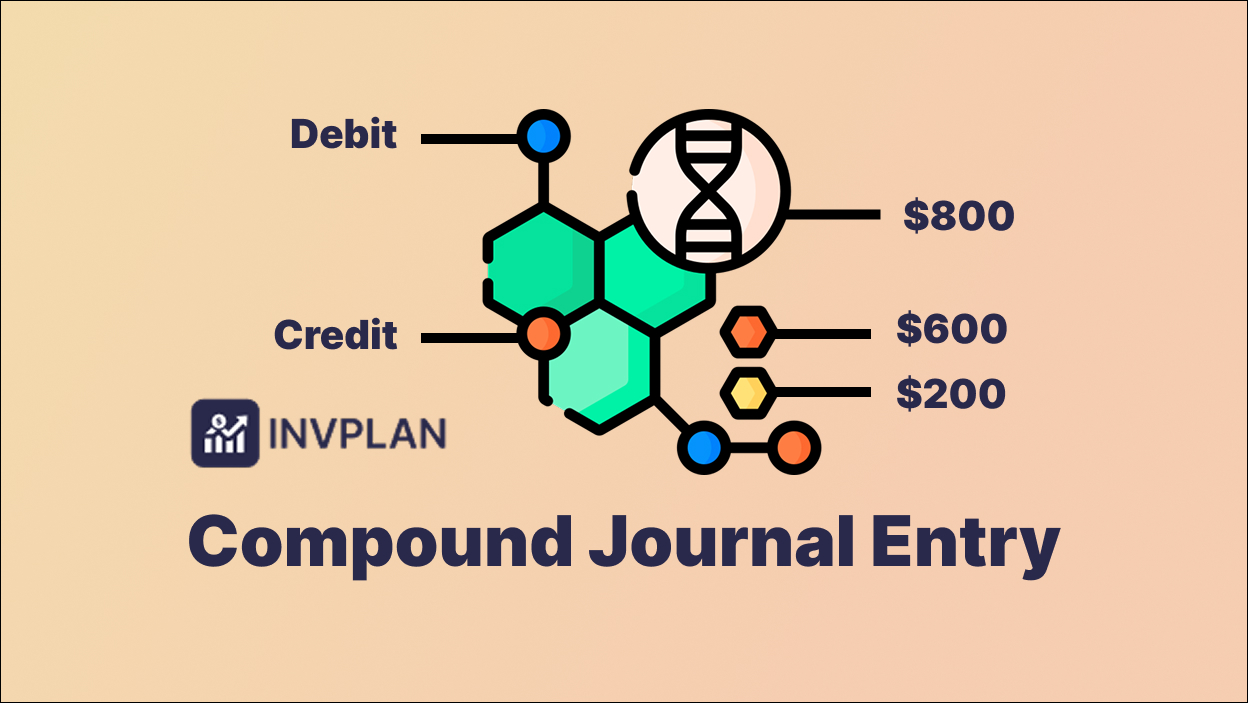

- Debits and Credits: Each transaction has two entries:

- Debits increase assets and expenses but decrease liabilities and revenue.

- Credits increase liabilities and revenue but decrease assets and expenses.

- Accounting Equation: The foundation of double-entry accounting:

- Assets = Liabilities + Equity that ensures that financial records stay balanced.

- General Ledger: A record of all transactions that are organized by account and provide a complete financial overview.

- Trial Balance: A report that lists all account balances to check if total debits equal total credits, ensuring accuracy.

Double-entry accounting has many types of accounts. Let’s take a look at each one in detail in the following section.

Types of Business Accounts in Double-Entry

These accounts fall into five main categories:

– Assets contain all resources that are owned by a business, such as cash, inventory, and equipment.

– Liabilities are debts such as loans and accounts payable.

– Equity refers to the owner of the business.

– Revenue shows money that is earned from sales or services.

– Expenses include costs incurred to run the business, such as rent and salaries.

Anyway, in the following section, you will understand how double-entry works in accounting.

How double-entry accounting works

Double-entry accounting tracks every financial transaction using two entries, which are a debit and a credit. Each transaction affects at least two accounts, ensuring the accounting equation stays balanced:

Assets = Liabilities + Equity

How It Works:

- Every transaction has two sides. One account gets debited, and another gets credited.

- Debits and credits must always balance. If you debit one account by $500, you must credit another by $500.

- Accounts fall into five categories:

- Assets (cash, inventory, equipment) – Increase with debits, decrease with credits.

- Liabilities (loans, accounts payable) – Increase with credits, decrease with debits.

- Equity (owner’s investment, retained earnings) – Increase with credits, decrease with debits.

- Revenue (sales, service income) – Increase with credits, decrease with debits.

- Expenses (rent, salaries, utilities) – Increase with debits, decrease with credits.

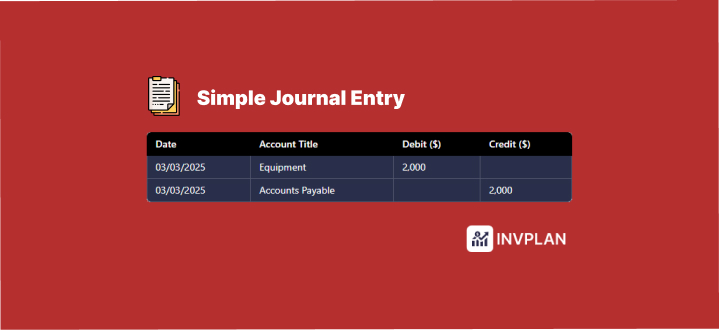

Here is an example:

A business buys $1,000 of office supplies on credit. The entries would be:

- Debit: Office Supplies (Asset) +$1,000

- Credit: Accounts Payable (Liability) +$1,000

This keeps the books balanced and accurate. It prevents errors, provides a clear audit trail, and helps track financial health.

Double-Entry vs. Single-Entry Accounting

Double-Entry Accounting

- Every transaction records two entries (debit and credit).

- It tracks assets, liabilities, equity, revenue, and expenses.

- Double-entry accounting keeps the accounting equation balanced: Assets = Liabilities + Equity.

- It reduces errors and provides a clear audit trail.

- Double-entry accounting is required for businesses that follow GAAP/IFRS, especially corporations and large businesses.

Here is an example:

A company buys $500 of inventory on credit.

Here are the key points:

- Debit: Inventory (Asset) +$500.

- Credit: Accounts Payable (Liability) +$500.

Here is a taable shows you, the double-entry in accounting:

| Account | Debit | Credit |

| Inventory (Asset) | 500 | |

| Accounts Payable (Liability) | 500 |

Single-Entry Accounting

- It records only one entry per transaction (either income or expense).

- Single-entry focuses on cash flow and tracking revenue with expenses only.

- No formal accounting equation.

- Not accurancy as it may make errors; lacks built-in checks and balances.

- Small businesses, freelancers, and sole proprietors with simple finances are using it.

Here is an example:

A freelancer gets paid $500 for a project.

So the entry would be like this: Revenue +$500 (No second entry).

Key Differences

| Feature | Double-Entry | Single-Entry |

|---|---|---|

| Entries per transaction | Two (debit & credit) | One |

| Tracks | Assets, liabilities, equity, revenue, expenses | Mostly income & expenses |

| Accuracy | Higher (built-in error checking) | Lower (prone to mistakes) |

| Complexity | More complex | Simple & easy |

| Best for | Large businesses, corporations | Small businesses, freelancers |

Double-entry accounting is more structured and prevents financial mismanagement. Single-entry is simple but lacks depth. The right system depends on the business’s size and complexity.

Wrapping Up

Double-entry accounting records every transaction in two places. This keeps the books accurate and helps track accounts such as assets, debts, income, and expenses.

It prevents mistakes and shows a full picture of a business’s finances. Banks, investors, and tax agencies require it for larger businesses.

Single-entry accounting records transactions once. It only tracks cash coming in and going out. This makes it easy to use but harder to spot errors or understand a business’s full financial health.