Simple journal entries keep records clear and prevent mistakes. They show where cash goes and help with taxes and reports. Companies can lose track of spending and earnings if they don’t use them.

In this article, you will see how to record simple journal entries with examples.

What are Simple Journal Entries

Simple journal entries record one debit and one credit for each transaction. They follow the double-entry system.

It ensures total debits equal to total credits. These entries track business transactions such as cash sales, expense payments, and asset purchases in an organized way.

For example:

- Cash sales such as debit cash and credit sales revenue.

- Paying rent like debit rent expense and credit cash.

They help track financial transactions clearly and accurately.

In the following section, you will learn more about its types of transactions.

Types of Transactions in Simple Journal Entries

Each business transaction affects different accounts. Below are some types of transactions recorded using simple journal entries:

- Cash transactions record cash received or paid.

- Revenue entries record earned income.

- Expense entries record payments for expenses.

- Asset purchases record equipment or inventory purchases.

- Liability payments record debt or loan repayments.

- Owner’s investment record money added by the owner.

- Owner’s withdrawal records money taken by the owner.

Anyway, let move onto the following part to see rules of simple journal entries.

Rules of Simple Journal Entries

Simple journal entries follow basic accounting rules. Here are the key rules:

- Every entry affects at least two accounts one increases (debit) and one decreases (credit).

- Debits and credits must always balance so the total amount debited must equal the total amount credited.

- Follow the accounting equation: Assets = Liabilities + Equity.

- Use correct account types:

- Assets increase with debits and decrease with credits.

- Liabilities increase with credits and also decrease with debits.

- Equity increases with credits but decreases with debits.

- Revenues increase with credits and decrease with debits.

- Expenses increase with debits but decrease with credits.

- Record transactions when they happen so use the accrual method if required.

- Provide a description. A brief note explains the reason for the entry.

Let’s see examples of these transactions in the section below.

Examples

Cash transaction (cash sale) example: A shopping market sells a product for $500 in cash.

| Date | Account | Debit | Credit |

|---|---|---|---|

| 03/03/2025 | Cash | 500 | |

| 03/03/2025 | Sales Revenue | 500 |

Revenue entry (credit sale): A company provides a service worth $1,000 on credit.

| Date | Account | Debit | Credit |

|---|---|---|---|

| 03/03/2025 | Accounts Receivable | 1,000 | |

| 03/03/2025 | Service Revenue | 1,000 |

Expense entry (rent payment): The business pays $800 in rent for its office.

| Date | Account | Debit | Credit |

|---|---|---|---|

| 03/03/2025 | Rent Expense | 800 | |

| 03/03/2025 | Cash | 800 |

Expense entry (utilities on credit): The garden receives a utility bill for $200, to be paid later.

| Date | Account | Debit | Credit |

|---|---|---|---|

| 03/03/2025 | Utilities Expense | 200 | |

| 03/03/2025 | Accounts Payable | 200 |

Asset purchase (cash purchase): The establishment buys new office furniture for $1,500 in cash.

| Date | Account | Debit | Credit |

|---|---|---|---|

| 03/03/2025 | Furniture | 1,500 | |

| 03/03/2025 | Cash | 1,500 |

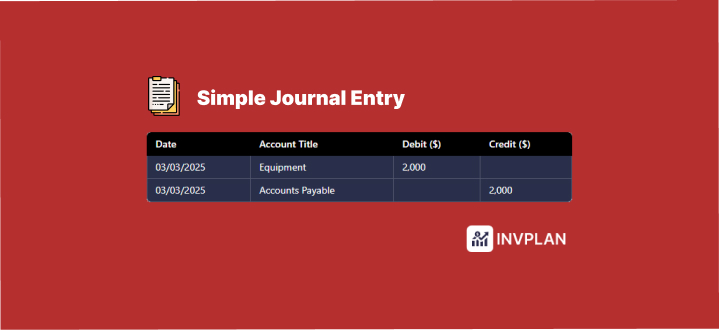

Asset purchase (credit purchase): Tarek buys a laptop for $2,000 on credit.

| Date | Account | Debit | Credit |

|---|---|---|---|

| 03/03/2025 | Equipment | 2,000 | |

| 03/03/2025 | Accounts Payable | 2,000 |

Sometimes, simple journal entries can go wrong if you are not careful. Here are potential mistakes and how to prevent them.

- Incorrect debit and credit placement

- Skipping transactions

- Forgetting to balance entries

So, always check that the total debits equal the total credits before finalizing an entry.

Wrapping Up

Simple journal entries help keep business records clear and accurate. Each transaction must have a correct debit and credit, with total debits always matching total credits.

To avoid mistakes such as incorrect placement of debit and credit or recording unbalanced entries. You have to check the total debits and credits. They should be equal.