Any business records money that goes out or comes in. Things get messy fast without a clear system. That’s where a journal entry comes into accounting. They track every transaction and keep financial records accurate and organized.

In this article, we will cover the following topics:

- The accounting journal entry definition.

- How debits and credits work in journal entries.

- Importance of journal entries.

- How to record a journal entry in accounting.

- The types of journal entries.

- Track and manage journal entries.

- Steps to create journal entries for your business.

- Use accounting software.

- Examples

Let’s get started with the main definition.

Understand What a Journal Entry is in Accounting

A journal entry records a financial transaction in accounting. It follows the double-entry bookkeeping system.

That means each transaction affects at least two accounts—one debited and one credited—to keep the accounting equation balanced.

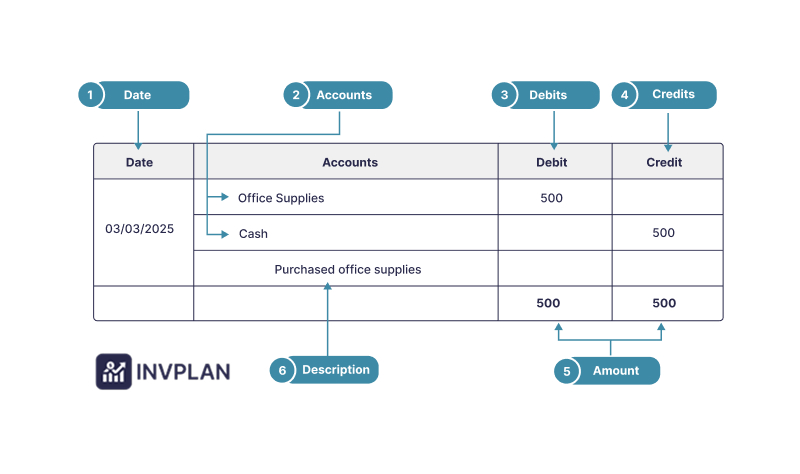

Here are the key parts of a journal entry:

- The date shows when the transaction happened.

- Accounts that are affected with debit and credit.

- Amounts specify the value of the debit and credit.

- The description explains the transaction briefly.

- The reference number assigns a unique ID for tracking.

Here are the components of the journal entry:

1- Debits and credits:

As we said before, it follows the double-entry system. So, every transaction affects at least two accounts—one is debited, and the other is credited. This keeps the accounting equation balanced:

Assets=Liabilities+Equity

2- Accounts Included:

Each entry impacts different types of accounts:

- Assets: cash, inventory, equipment

- Liabilities: loans, accounts payable

- Equity: owner’s capital, retained earnings

- Revenue: sales, service income

- Expenses: rent, salaries, utilities

3- General ledger and journal entries:

Journal entries are first recorded in a journal (the book of original entry). They are posted to the general ledger. That organizes transactions by account.

This process ensures accurate financial reports and helps produce financial statements.

So, what are the three rules of a journal entry?

There are three main rules you have to follow when you write a journal entry:

- Any transaction must have at least one debit and one credit to keep the books balanced.

- Total debits must always equal total credits

- Debits increase assets and expenses, but credits increase the statement components (liabilities, equity, and revenue).

Let’s move on to the section below to see why the journal entry is important for business.

The Importance of Journal Entries for a Business

Journal entries are important because they keep a company’s financial records accurate and organized. Here’s why they matter:

- They record all money coming in and going out and ensure nothing gets missed.

- The double-entry system keeps the books balanced and reduces errors.

- They feed into the general ledger that is used to create reports like the balance sheet and income statement.

- Accurate records help business owners make informed financial decisions.

- Proper records help meet tax and legal requirements.

Let’s move into the following section to understand how to record a journal entry.

Record a Journal Entry

Here are the steps to record a journal entry in accounting:

- Figure out and identify what transactions happened, such as sales and expenses.

- Determine which accounts are involved. Each transaction affects at least two accounts in double-entry accounting.

- Decide which accounts to debit and which to credit.

- Write down the date of the transaction to keep things in order.

- List the amounts for debits and credits. Make sure the total debits match the total credits.

- Write a simple explanation of the transaction for future reference.

- Then, transfer it to the general ledger after the journal entry is made, where transactions are sorted by account.

Let’s move on to the following section to understand the types of journal entries in accounting.

Types of Journal Entries

There are many different journal entries in accounting that help you manage and accurately record your company’s transactions. Here is a list that shows you all:

- Simple journal entry.

- Compound journal entry.

- Adjusting journal entry.

- Reversing journal entry.

- Closing journal entry.

- Opening journal entry.

- Transfer journal entry.

- Rectifying journal entry.

- Intercompany journal entry.

Let’s take a look at each one in-depth:

Simple Journal Entry

The simple journal entry records transactions with one debit and one credit account. It is the basic form of journal entry.

Here is an example:

The business pays a $300 utility bill in cash.

| Date | Account Titles | Debit | Credit |

|---|---|---|---|

| MM/DD/YYYY | Utilities Expense | $300 | |

| Cash | $300 |

This entry records the payment of a utility bill. It increases the Utilities Expense account (debit) and decreases the Cash account (credit).

Compound Journal Entry

The compound journal entry includes multiple debits and/or credits in a single transaction. Used for complex transactions that affect more than two accounts.

Let’s see an example:

A company processes its payroll and distributes wages to employees while accounting for various deductions such as taxes and benefits:

- Gross wages: $10,000

- Income tax withheld: $2,000

- Retirement contributions: $500

- Health insurance premiums: $300

- Net wages paid: $7,200

The compound journal entry to record this payroll transaction would be:

| Date | Account | Debit | Credit |

|---|---|---|---|

| MM/DD/YYYY | Salaries Expense | 10,000 | |

| Income Tax Payable | 2,000 | ||

| Retirement Contributions Payable | 500 | ||

| Health Insurance Payable | 300 | ||

| Cash | 7,200 |

This entry shows the total salary cost. It includes any deductions and the amount of cash paid to employees.

Adjusting Journal Entry

Adjusting journal entries made at the end of an accounting period to allocate income or expenses to the correct period. It helps you to report accurate financials.

For example:

A law firm provides legal services worth $5,000 in December but hasn’t billed the client by year-end.

Here is the adjusting Entry:

| Date | Account Titles | Debit | Credit |

|---|---|---|---|

| 12/31/YYYY | Accounts Receivable | 5,000 | |

| Service Revenue | 5,000 |

It recognizes the revenue earned in December, even though the cash hasn’t been received.

Reversing Journal Entry

The reversing journal entry is created at the start of a new accounting period to reverse adjusting entries. Simplifies the recording of subsequent transactions.

Here is an example:

A company accrues $5,000 for wages earned by employees but not yet paid at the end of December.

Adjusting entry on December 31:

| Date | Account Titles | Debit | Credit |

|---|---|---|---|

| 12/31/YYYY | Wages Expense | 5,000 | |

| Wages Payable | 5,000 |

Reversing entry on January 1:

| Date | Account Titles | Debit | Credit |

|---|---|---|---|

| 01/01/YYYY | Wages Payable | 5,000 | |

| Wages Expense | 5,000 |

Subsequent Payment on January 5:

| Date | Account Titles | Debit | Credit |

|---|---|---|---|

| 01/05/YYYY | Wages Expense | 5,000 | |

| Cash | 5,000 |

The reversing entry on January 1 cancels out the accrued wages expense from December.

It records the full amount as an expense and ensures that the expense is not double-counted when the wages are paid on January 5.

Closing Journal Entry

Closing journal entry transfers balances from temporary accounts (e.g., revenue and expenses) to permanent accounts (e.g., retained earnings) at the end of a period.

For example:

Transfer credit balances from revenue accounts to the Income Summary account.

| Account | Debit | Credit |

|---|---|---|

| Service Revenue | 10,000 | |

| Income Summary | 10,000 |

Transfer debit balances from expense accounts to the Income Summary account.

| Account | Debit | Credit |

|---|---|---|

| Income Summary | 7,000 | |

| Rent Expense | 3,000 | |

| Salaries Expense | 4,000 |

Transfer the net balance of the Income Summary account to the Retained Earnings account.

| Account | Debit | Credit |

|---|---|---|

| Income Summary | 3,000 | |

| Retained Earnings | 3,000 |

This entry reflects the net income for the period being added to retained earnings.

Opening Journal Entry

Opening journal entry records the initial balances of (assets, liabilities, and equity) when a new accounting period begins. It is used in manual accounting systems.

For example:

A Greek company has the following balances at the end of the previous accounting period:

- Assets:

- Cash: $50,000

- Accounts Receivable: $30,000

- Inventory: $20,000

- Equipment: $100,000

- Liabilities:

- Accounts Payable: $25,000

- Long-term Loan: $75,000

- Equity:

- Common Stock: $60,000

- Retained Earnings: $40,000

The opening journal entry for the new accounting period would be:

| Date | Account | Debit | Credit |

|---|---|---|---|

| 01/01/20XX | Cash | $50,000 | |

| Accounts Receivable | $30,000 | ||

| Inventory | $20,000 | ||

| Equipment | $100,000 | ||

| Accounts Payable | $25,000 | ||

| Long-term Loan | $75,000 | ||

| Common Stock | $60,000 | ||

| Retained Earnings | $40,000 |

Note: The total debits equal the total credits ($200,000). It maintains the balance as required by the double-entry bookkeeping system.

Transfer Journal Entry

The transfer journal entry moves amounts between accounts without affecting the overall financial position.

Often used for internal account adjustments. For example:

If you move $1,000 from the Marketing Department’s budget to the Sales Department’s budget, it looks like this:

| Date | Account | Debit | Credit |

|---|---|---|---|

| 03/13/2025 | Marketing Expense | $1,000 | |

| Sales Expense | $1,000 |

$1,000 is transferred from the Marketing Expense account to the Sales Expense account, reflecting the reallocation of funds.

Rectifying Journal Entry

The rectifying journal entry corrects errors made in previous journal entries. Ensures the accuracy of financial records.

For example:

A payment of $5,000 for rent was mistakenly debited to the Wages Account instead of the Rent Account.

Incorrect Entry:

| Account | Debit | Credit |

|---|---|---|

| Wages Expense | 5,000 | |

| Cash | 5,000 |

Rectifying Entry:

| Account | Debit | Credit |

|---|---|---|

| Rent Expense | 5,000 | |

| Wages Expense | 5,000 |

Intercompany Journal Entry

The intercompany journal entry records transactions between two entities within the same parent organization. Eliminates internal balances during consolidation.

Here is an example:

The Parent Company (Company P) sells goods worth $10,000 to Subsidiary A. The cost of the goods for Company P is $6,000.

Parent Company (Company P) Journal Entry:

Date: YYYY-MM-DD

Account Debit Credit

------------------------------------------------------

Accounts Receivable (Subsidiary A) 10,000

Sales Revenue 10,000

Cost of Goods Sold 6,000

Inventory 6,000

Subsidiary A Journal Entry:

Date: YYYY-MM-DD

Account Debit Credit

------------------------------------------------------

Inventory 10,000

Accounts Payable (Company P) 10,000

But what are the most common journal entries used by companies? Let’s answer this question in the following section and explain why.

The Most Common Journal Entries Used by Companies

A simple and common journal entry happens when a company makes a cash sale. The company must record the transaction in its books when goods or services are sold for cash.

This entry shows the cash increase and the revenue from the sale. It’s important because it helps track both income and cash flow, which are key for the business.

The company creates an accounts payable entry when it buys goods or services on credit. This means the company now owes money to suppliers or vendors.

This entry records the increase in inventory and the liability (amount owed) to the supplier. It is important because it makes sure the company’s liabilities are properly recorded and tracked.

The industry needs to update its accounts when it receives payment from a customer for credit sales. This entry reduces accounts receivable and increases cash.

Also, payroll entries are necessary to record salaries and wages paid to employees. They impact various accounts, such as: (salary expenses, payroll taxes, and cash or bank accounts).

Payroll entries make sure that labor costs are properly accounted for and paid, which is important for tax and financial reporting.

Anyway, in the following section, you will learn how to track journal entries.

How to Track and Manage Journal Entries?

Here are some important point that allows you to track and manage journal entries:

Set Clear Rules and Steps:

Set clear rules that explain each team member’s job. list the needed documents and outline the approval process for journal entries.

This helps keep things consistent and makes sure everyone is responsible for their work.

Use Strong Internal Controls:

Put controls in place and separate duties. Set up approval limits and perform regular checks.

These steps reduce mistakes and prevent fraud in journal entries.

Train Employees Well:

Make sure employees who handle journal entries receive training on company rules. Also, they follow proper steps and learn best practices. Well-trained staff keep financial records accurate and consistent.

Now, let’s move on to the next section to learn how to create a journal entry for your company.

Steps to Create Journal Entries for Your Business

Here are the simple steps:

1- Understand the transaction:

Determine what happened, like a sale, purchase, or payment. Be sure to know the date and amount of the transaction.

2- Choose the accounts:

Decide which accounts are involved.

For example:

You might use “Cash” or “Accounts Receivable” and “Sales Revenue.” If you make a sale.

3- Record the debit and credit:

Write one account as a debit and another as a credit for each transaction. Debits and credits always need to balance.

4- Write a description:

Add a short note that explains the transaction. This helps others to understand why it was made.

5- Double-check the entry:

Make sure the amounts are right and that the debit and credit balances. You may face mistakes that can lead to problems in your financial records.

6- Post the entry:

Post the journal entry to your accounting system or general ledger once everything is correct.

7- Review regularly:

Check journal entries often to make sure they’re accurate and find where there are mistakes.

Let’s see how to use accounting software with journal entries.

Use Accounting Software in Journal Entry

Companies use software to record journal entries. Here is how to use them:

1- Access the journal entry feature:

Go to the journal entry section in your accounting software. If you use QuickBooks Online. You have to click on the “+ New” button. Then select “Journal entry.”.

2- Enter transaction details:

- Choose the date of the transaction in the date filed.

- select the accounts for debits and credits.

- Make sure the debit and credit amounts. And ensure they balance.

- Write a short explanation of the transaction.

3- Review and confirm:

Check the details to make sure everything is correct and verify the following information such as:

- Accounts.

- Amounts.

- Descriptions.

This helps you to ensure that your financial reports are accurate.

4- Save the entry:

Save the journal entry. The software will update your records automatically.

Let’s move on to the following part to see real examples.

Examples of Journal Entries

Examples 1: Borrow money from the bank.

ABC Company borrows $300,000 from the bank.

Analysis:

- The cash account will increase by $300,000 (the company receives cash).

- The bank loan Payable Account will increase by $300,000 (the company owes the bank).

Here is the journal entry:

Date Account Debit ($) Credit ($)

--------------------------------------------------------------

2025-03-13 Cash 300,000

Bank Loan Payable 300,000

Borrow money from the Bank

Example 2: Buy equipment with cash.

LCICO Company buys equipment worth $650,000, paying in cash.

Analysis:

- The cash account will increase by $300,000 (the company receives cash).

- The bank loan payable account will increase by $300,000 (the company owes the bank).

Here is the example in the journal entry:

Date Account Debit ($) Credit ($)

----------------------------------------------------------

2025-03-13 Cash 300,000

Bank Loan Payable 300,000

Buy equipment with cash

Example 3: Buy inventory on credit.

AFADA Company buys inventory worth 90,000.

It pays 90,000 and pays 10,000 in cash and owes $80,000.

Analysis:

- Inventory Account will increase by $90,000 (new stock).

- Cash Account will decrease by $10,000 (partial cash payment).

- Accounts Payable Account increases by $80,000 (amount owed to suppliers).

Here is the journal entry:

Date Account Debit ($) Credit ($)

2025-03-13 Inventory 90,000

Cash 10,000

Accounts Payable 80,000

Buy inventory on credit.

Example 4: Buy land and buildings.

FlatCoding Company buys land for 50,000 and buildings for 50,000 and buildings for 400,000, paying 100,000 in cash and owing 100,000 in cash and owing 350,000.

Analysis:

- Land Account increases by $50,000 (land purchase).

- Buildings Account increases by $400,000 (building purchase).

- Cash Account decreases by $100,000 (cash payment).

- Note Payable Account increases by $350,000 (amount financed).

Here is the journal entry:

Date Account Debit ($) Credit ($)

--------------------------------------------------------------

2025-03-13 Land 50,000

Buildings 400,000

Cash 100,000

Note Payable 350,000

Buy land and buildings

Example 5: Pay interest on a loan.

Abo Keer Company pays $200 in interest on a bank loan.

Analysis:

- Interest Expense Account increases by $200 (cost of borrowing).

- Cash Account decreases by $200 (payment made).

Here is the journal entry:

Date Account Debit ($) Credit ($)

-----------------------------------------------------------

2025-03-13 Interest Expense 200

Cash 200

Pay interest on a loan

Example 6: Receive cash from a customer for a previous credit sale.

XYZ Company receives $15,000 from a customer for a previous credit sale.

Analysis:

- Cash Account increases by $15,000 (money received).

- Accounts Receivable decreases by $15,000 (reducing the amount owed by the customer).

Here is the journal entry for this example:

| Date | Account | Debit ($) | Credit ($) |

|---|---|---|---|

| 2025-03-13 | Cash | 15,000 | |

| Accounts Receivable | 15,000 | ||

| Receive cash from customer |

Example 7: Pay employee salaries.

TechGrow Company pays $50,000 in salaries to employees.

Analysis:

- Salaries Expenses increeses by $50,000 (expense recorded).

- Cash Account decreases by $50,000 (payment made).

Here is the journal entry:

| Date | Account | Debit ($) | Credit ($) |

|---|---|---|---|

| 2025-03-13 | Salaries Expense | 50,000 | |

| Cash | 50,000 | ||

| Pay employee salaries |

Example 8: Provide services on credit.

Global Solutions Company provides consulting services worth $25,000 to a client on credit.

Analysis:

- Accounts Receivable increases by $25,000 (customer owes money).

- Service Revenue increases by $25,000 (income earned).

Here is the journal entry:

| Date | Account | Debit ($) | Credit ($) |

|---|---|---|---|

| 2025-03-13 | Accounts Receivable | 25,000 | |

| Service Revenue | 25,000 | ||

| Provide services on credit |

Wrapping Up

Journal entries are important for any accounting system. They keep a business’s financial records clear and accurate. And also track every transaction.

They help businesses stay organized and balanced. They Keep track of money that is coming in and going out without journal entries is hard.

Journal entries follow simple rules. Each transaction involves a minimum of one debit and one credit, with total debits always matching total credits.

Each entry affects accounts like (cash, expenses, or loans). This helps the business know exactly where its money is.

Different types of journal entries.

- Simple entries record one debit and one credit.

- Compound entries are for more complex transactions with more than two accounts.

- The adjusting entries make sure the right income and expenses appear in the right period.

- Other types include reversing, closing, and opening entries, which help manage records over time.

Using accounting software helps you to manage journal entries. It helps companies save time and reduce errors. Regular checks and the training of employees also help you to keep everything accurate.

What is a journal entry in accounting?

What are five examples of journal entries?

- Cash Sales Entry – Recording sales made in cash.

- Credit Purchase Entry – Recording purchases made on credit.

- Salary Payment Entry – Recording employee salary payments.

- Bank Loan Entry – Recording money borrowed from a bank.

- Depreciation Entry – Recording the reduction in asset value over time.

How do you write a journal entry in accounting?

- Identify the transaction – Determine the accounts involved.

- Classify accounts – Decide which accounts to debit and credit.

- Record the entry – Use the standard format:

-

- Date: The date of the transaction.

- Accounts: List the affected accounts.

- Debit and Credit amounts: Enter the respective amounts.

- Description: Briefly explain the transaction.

Date Account Debit ($) Credit ($)

---------------------------------------------------

2025-03-13 Rent Expense 1,000

Cash 1,000

Rent payment

What do Dr and Cr stand for?

- Dr (Debit) stands for an increase in assets or expenses and a decrease in liabilities or equity.

- Cr (Credit) stands for an increase in liabilities, equity, or revenue and a decrease in assets or expenses.

What is the full meaning of Dr and Cr?

- Dr (Debit) comes from the Latin word "debere," meaning "to owe."

- Cr (Credit) comes from the Latin word "credere," meaning "to entrust.

What is Dr and Cr in a journal entry?

- Dr (Debit) is recorded on the left side and increases assets or expenses.

- Cr (Credit) is recorded on the right side and increases liabilities, equity, or revenue.

What are the 7 rules of debit and credit?

- Assets → Increase (Dr), Decrease (Cr).

- Liabilities → Increase (Cr), Decrease (Dr).

- Equity/Capital → Increase (Cr), Decrease (Dr).

- Revenue → Increase (Cr), Decrease (Dr).

- Expenses→ Increase (Dr), Decrease (Cr).

- Drawings/Withdrawals → Increase (Dr), Decrease (Cr).

- Dividends → Increase (Dr), Decrease (Cr).

What is the rule of Cr and Dr?

- Debit what comes in while credit what goes out.

- Debit expenses and losses while credit incomes and gains.

How do you identify debit and credit in journal entries?

- Determine the nature of the transaction.

- Classify the affected accounts (Asset, Liability, Equity, Revenue, or Expense).

- Apply the debit and credit rules:

-

- If an asset or expense increases → Debit

- If an asset or expense decreases → Credit

- If a liability, revenue, or equity increases → Credit

- If a liability, revenue, or equity decreases → Debit

Date Account Debit ($) Credit ($)

-----------------------------------------------------

2025-03-13 Cash 5,000

Service Revenue 5,000

Record cash received from services