The accounting appeared to help companies or individuals know how much they traded or owed. This helped them organize records as trade grew and understand where their resources were going. We will cover the accounting meaning, history, and what it matters.

Systems became more complex to handle the growing scale of economic problems.

Here are the topics we will explain:

- What accounting is and what key principles are.

- How accounting works.

- Types of accounting.

- Importance of accounting.

- Accounting cycle.

Let’s move on to the section below to understand the definition of accounting.

What Is Accounting?

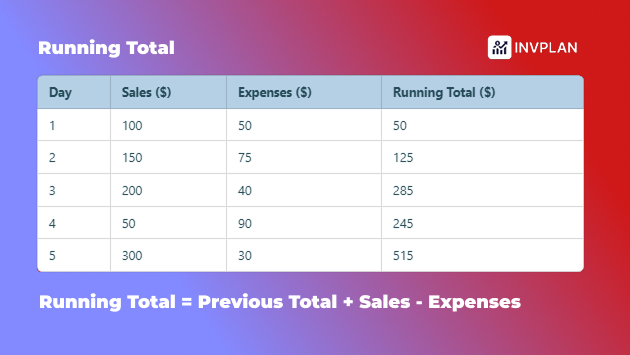

Accounting can be described as the process of analyzing, sorting, documenting, summarizing, and making sense of business transactions. A major part of this process involves keeping “running totals” of various “things.”.

You always want these running totals to be up to date so they’re ready when you need them—like checking your bank balance before using your debit card so you don’t end up in an embarrassing situation at checkout!

Here is an example of the running total:

We can refer to the running total as a balance and link it to accounts. Any business or individual that wants to keep track of it can show a running balance.

This determines (How much is available now?) and (How much has been accumulated so far?).

Anyway, let’s explain the four keywords in the accounting definition in depth:

Analyzing

This concept refers to the money coming in and going out to check for mistakes or ask your team why expenses seem too high!

Sorting

This process helps you track where money goes and place transactions into accounts such as income, expenses, assets, and debts.

Documenting

It means the records and transactions that have been written in the system, such as invoices, receipts, and bank statements. So, any question in the future related to this will have tangible proof.

Summarizing

Take all the financial info and put it into reports. These reports show if the business is making or losing money. This helps the company to make a decision.

So, Why Is Accounting Important? Let’s answer this question in the following section.

Importance of Accounting

Here are 5 reasons that show you why accounting is important for companies and businesses:

Help Companies to Track Financial Situation

It records many transactions such as profits, losses, and cash flow. It also helps companies to see their financial situation in a specific period.

Ensures Legal Compliance

It enables businesses to report earnings and pay taxes correctly which prevents legal trouble or audits. It keeps financial records clear for government agencies.

Help in Decision-Making

All owners are using accounting to track costs and profits which makes them decide when to invest or adjust pricing.

Improves Cash Flow Management

It helps companies to know when money comes in and goes out which will avoid missed payments or running out of cash.

Builds Trust with Investors and Banks

It also helps lenders and investors understand accurate financial records. This exposes the financial situation of the establishment.. So without accounting businesses may struggle to get loans or investments.

Anyway, you will learn more about the history of accounting in the following part.

A Brief History of Accounting

Accounting history spans thousands of years. Throughout those years, it has evolved from simple record-keeping in ancient civilizations to a complex system. Here is a quick recap of its history:

Ancient History

Mesopotamia (4000-3100 BCE)

Accounting dates back over 7,000 years, as it was used to track goods and stock in simple writing and counting.

Babylon, Assyria, and Sumer

Primitive accounting was used to record and calculate the crop and herd growth.

Ancient Egypt and Babylon

The accounting system was developed to monitor storehouse movements. This is mentioned in the Old Testament when said that Moses assigned Ithamar to account for materials used in building the Tabernacle.

Roman Empire (27 BCE – 14 CE)

The government maintained detailed financial records such as cash, commodities, and transactions.

Medieval and Renaissance Periods

Islamic Influence (8th Century)

The Qur’an mentioned keeping records of indebtedness which led to advancements in accounting for inheritance and estate management. Also, algebra appeared in this era through Muhammad Ibn Musa al-Khwarizmi.

Tang Dynasty (China, 8th Century)

They developed double-entry bookkeeping to manage complex bureaucracies and paper currency.

Double-Entry Bookkeeping in Europe

The oldest instance of double-entry bookkeeping in Europe can be traced to the Farolfi ledger (1299–1300) and Messari accounts of Genoa (1340).

So, Luca Pacioli is known as the ‘Father of Accounting. In 1494, he published the first printed treatise on double-entry bookkeeping (Summa de Arithmetica).

Renaissance and Early Modern Period

The Renaissance saw the growth of banking centers in Italy where double-entry bookkeeping became widely used.

The rise of joint-stock companies created a need for financial accounting to inform investors.

Modern Professional Accounting

- The Industrial Revolution and the rise of limited liability companies created a need for skilled accountants.

- In England, local professional bodies merged to form the ICAEW in 1880.

- Similar organizations were formed in the United States (AICPA, 1887) and Canada (CICA, 1902).

- These accounting standards and regulatory frameworks emerged due to the need for a stable and reliable financial reporting structure.

- Terms like CPA and CMA have gained recognition.

Anyway, in the section below you will understand how accounting works in-depth.

How Does Accounting Work?

Accounting gives you a systematic way to ensure that financial information is accurate. This can happen through the following steps:

1- Recording Transactions (Bookkeeping)

This process collects and records all financial transactions, such as source documents, journal entries, the double-entry system, and posting to the ledger.

So, they start by gathering the source documents such as invoices, receipts, bank statements, or purchase orders.

Firstly, they record all of these transactions in a journal that lists all financial activities by date, accounts affected, amounts, and a brief description.

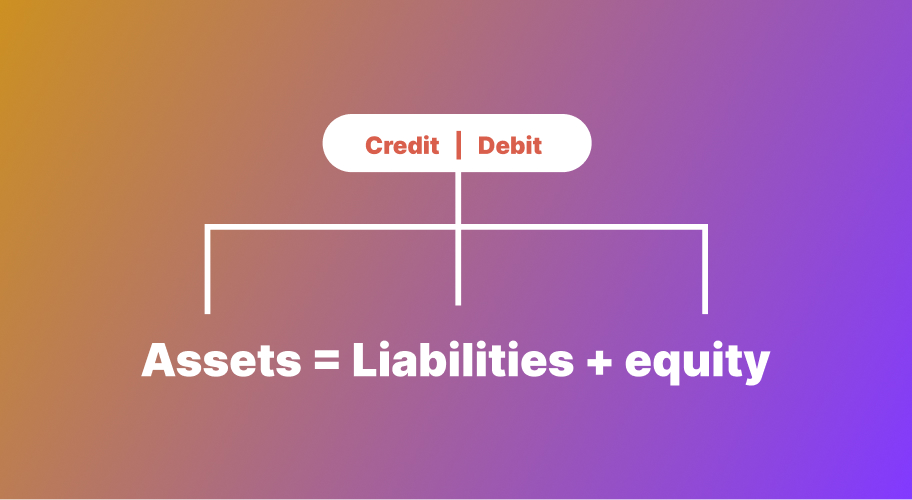

Some companies store transactions in a double-entry system where every transaction affects at least two accounts that appear as (debit and credit).

Then, the journal entry is transferred to the general ledger to organize these transactions by accounts such as cash, accounts receivable, inventory, and expenses.

2- Classifying and Organizing Data

All transactions recorded in the previous processes are going to be classified as categories. This includes the following two items:

- The chart of Accounts contains a list of all accounts that are used by the business such as assets, liabilities, equity, revenue, and expenses.

- Sub-Ledgers to track details about money owned by customers and suppliers such as accounts receivable and accounts payable

3- Summarizing Financial Data

Here, the accounting team has to summarize and prepare the documents for reporting purposes.

This step includes the following:

- Trial Balance is prepared at the end of an accounting period to ensure that debits equal credits.

- Adjusting Entries to reflect accruals, deferrals, depreciation, and other items that aren’t captured in daily transactions.

4- Preparing Financial Statements

The accounting team prepares financial statements from the previous step. These include:

- The income Statement (Profit & Loss Statement) answers questions about “How profitable is the business?” through revenue, expenses, and profit or loss at a specific period.

- The Balance Sheet provides a snapshot of the business’s financial position at a specific time.

- Cash Flow Statement tracks the inflow and outflow of cash and financing activities.

- Statement of Changes in Equity shows changes in equity over the period, including contributions, withdrawals, and retained earnings.

5- Analyzing and Interpreting Data

The business performance can be assessed through statements that allow the company to evaluate its financial health. This analysis helps stakeholders make informed decisions.

6- Reporting and Compliance

The accounting team shares the financial reports with stakeholders to ensure consistency and transparency. That includes the following:

- Internal Stakeholders

- External Stakeholders

- Tax Authorities

7- Closing the Books

Here, the books are closed to prepare for the next period at the end of the accounting period. This includes:

- Temporary Accounts include accounts such as revenue, expenses, and dividends, which are closed to zero, and their balances are transferred to retained earnings.

- Permanent Accounts include asset, liability, and equity accounts, which carry forward to the next period.

In the following section, you will understand what the accounting cycle is and how it works.

What Is the Accounting Cycle?

We can define the accounting cycle as a process businesses use to record and manage financial transactions. This process ensures accurate financial statements. Here are the steps:

- Record all business activities that affect money.

- Write each transaction in a journal with details like the date, amount, and accounts involved.

- Transfer journal entries to the general ledger which organizes transactions by account.

- List all accounts and their balances to check if debits and credits match.

- Make corrections for items like unpaid expenses or earned but unrecorded revenue.

- Update the trial balance to reflect adjustments.

- Prepare reports like the income statement, balance sheet, and cash flow statement.

- Reset temporary accounts (revenues and expenses) to start fresh for the next cycle.

- Double-check that all permanent accounts are accurate before a new cycle begins.

Let’s see what accounting types are in the section below.

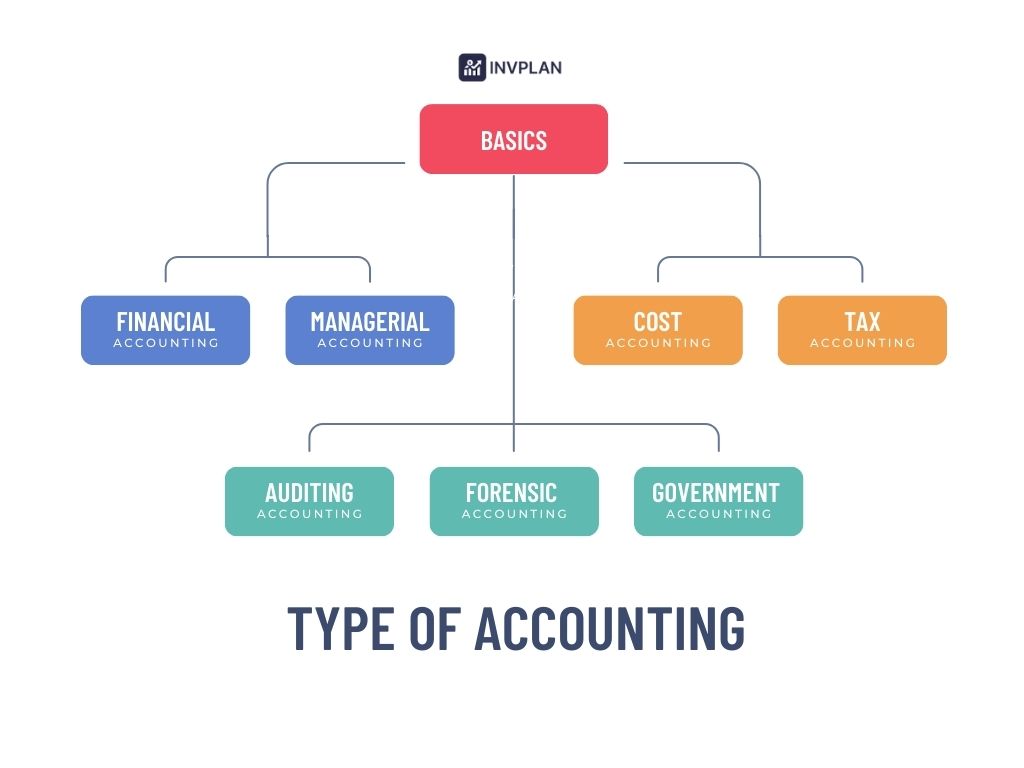

Accounting Types

Accounting has different types based on purpose and industry. Here are:

- Financial Accounting: This type records business transactions and creates financial statements like income statements and balance sheets.

- Managerial Accounting: It focuses on internal reports for business decisions. It includes budgeting, cost analysis, and performance tracking.

- Cost Accounting: Tracks production costs and helps businesses to set prices and control expenses.

- Tax Accounting: This type follows tax laws to prepare returns and plan payments.

- Government Accounting: This type manages public funds. It ensures government agencies follow laws and use money properly.

- Forensic Accounting: It investigates fraud and legal disputes.

- Fiduciary Accounting: tracks finances for estates and guardianships to ensure proper handling of funds for beneficiaries.

Wrapping Up

We covered many things in this article such as the accounting definition and why it matters. Here is a quick recap:

- Accounting tracks money in and out of a business and does many processes such as recording transactions, organizing financial data, and helping you with decision-making.

- It shows you the financial situation and guides budgeting. It also helps businesses plan for growth.

Thank you for reading.